The goal of this thread is to have a single repository for the discussion surrounding the VideoCoin incentive system and to improve the tokenomic structure over time for optimum network performance and relative competitiveness vis-a-vis centralized CDNs.

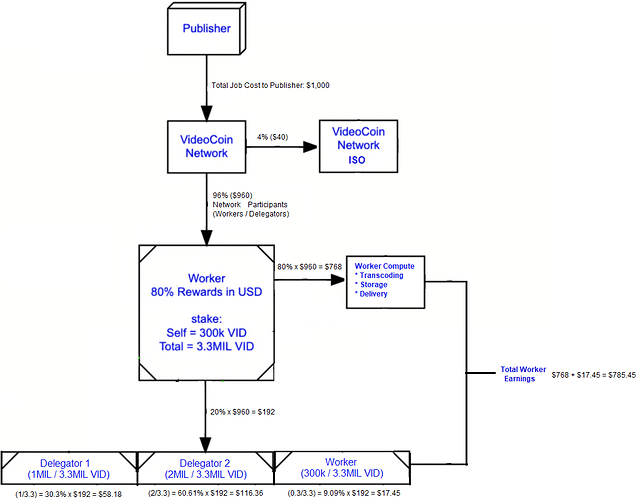

The following is a reproduction of the diagram displayed at the most recent video webinar on VIDPOOL. During the webinar you acknowledged that the math was not accurate but that it exemplified the value flow. I’ve taken the liberty of calculating the math but I’m not sure if this is really how it works. The following graphic and questions need verification and/or clarity from the VC team:

Q1. Is the math correct?

Q2. Are the assumed percentages correct? If not, what are they?

Q3. Can the percentages be changed depending on circumstances? If so, what are those circumstances?

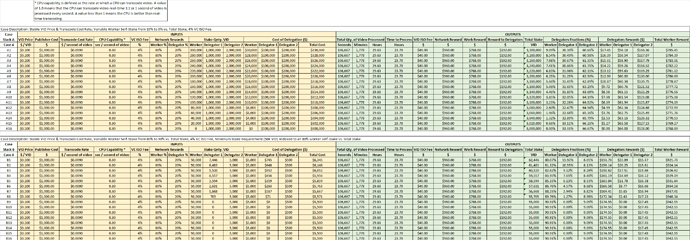

I ran some basic calculations with extremes to explore the tradeoffs a Worker must weigh in terms of acquiring VID vs. sharing network rewards.

The first stack of cases assumes that the Delegators have the vast majority of VID staked towards a job, (a minimum relative fraction of 90%) thus maximizing their fraction of the network rewards. For a $1000 job the Worker total earnings varies from $785 to $768, assuming a Worker self-stake fraction of the total between 9% and 0.0% (as exemplified by the graphic below). In this scenario the price of VID was set at $0.10/token and the job reward at ~ $0.009 / second of video transcoded.

I ran a similar exercise at the other extreme. The Worker has the minimum stake VID (50,000K) but in relative terms comprises between 80 - 90% of the total stake fraction. In this second case the Total Worker Rewards varied between $922 & $942, which is about a 22% increase in worker $ yield for a 70% increase in required VID. It therefore seems uneconomical as a worker to attempt to self-stake in quantities greater than the delegators because the ROI is poor.

See graphic of results.

Are you sure this is right? So according to your calculation if worker stakes 50000 VID to himself then that count as delegated staking? I thought workers stake is like deposit which is saying I am serious and has no right to receive delegated reward. Can some one clarify this? If this is true then our node operator has less reason to buy VID coin unlike the Ethereum which in turn drive coin demand.

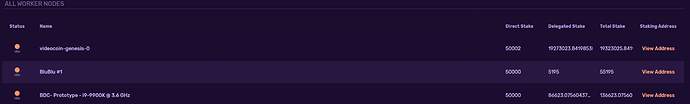

Yes, I’m fairly confident that worker self-stake enters into the total stake calculation. You can see this as reported on the network website. If you think of VID as a lottery ticket for earning the right to work, the worker self-stake just adds to the lottery pool. This incentivizes both workers & delegators to bring as much VID to bare (within economic prudence) to earn the right to work.

What my conclusions show is that as a worker, you want to put the minimum VID and then share it with delegators. The reason is simple, optimum capital allocation. If I’m a worker I can either go buy VID for $20,000 or I can buy $20,000 worth of CPUs to process more work. The productive capacity of my pool increases with increasing CPU purchases, not VID purchases. Of course this assumes two things (1) a saturated network, meaning there is enough work to go around, (2) the minimum stake amount is high relative to CPU costs. If they lower the minimum staking amount then it may become economical to try and not share the 20% with delegators and you can do that by having a lot more self-stake.

Does that make sense?

My concern is delegator staking reward rate

Below is all my wild guess. we will have to actually see how profitable this operation is but below is my wild imagination and guess.

I want to hear what you think about the below guess.

Because you might have a better idea.

Right now IBM sells 20 concurrent connection for $999 a month with all the added options

But, let’s just think about 20 concurrent connections for $999 a month.

If we sell this at a 50% discount then it is $500 a month we can get from the publisher.

To make 20 concurrent connections with Jetson Nano we need 5 Jetson Nano.

That makes 5 nodes.

Out of $500 revenue, 80% is for workers take.

Which is $400 and we divide that with 5 because we have five servers( Jetson Nano)?

Which is about $80 a month a Jetson nano can make.

And out of that 20 % of for delegated stakers

which is 16 dollars a month for delegators

If a delegator makes $16 per month delegating 50000 vid than

$16 * 12 month = $192 dollars for year.

50000 vid sells 0.125 cent which is $6250

If delegator makes $192 a year delegating $6250

That is about 3% annual reward rate.

Which is a disappointing reward rate.

Somehow we were under the impression that delegators can make 16% a year of total coin staked.

Again we will have to actually run and see the reward but I can not see myself being happy delegating 50000 vid to a single CPU.

You can then see what will happen if more people delegate coins to the same node as I have. The reward rate will go down further.

As you can see the low reward rate is one of my concerns.

Am I missing something here?

It would come down to their payment structure. At current settings its .025$ per minute x 1440 minutes/day = 36$ a day x 365 days = 13,140$ x .8 (worker share) = 10,512$ x .2 (delegator share) = 2,102$ at 100% uptime for the entire year

With how much of hardware do you think you can make that kind of money a year?

It seems like it’s going to take a lot of hardware to make above money you say.

Your calculation does not answer everything. It leaves more questions.

1 stream? That seems to be too much money for one stream. It does not make sense

IBM sells 20 concurrent connection for $12000 a year. 1 stream for $12000 is too much money and it does not make real world sense.

That would be publisher pricing at current pricing model to stream 1 stream every minute of the year.

Think about this Netflix charge you like $9.99 a month for 4 concurrent connections.

That is $120 a year. I know you do not watch Netflix 24 hours but think about it.

I’m not disagreeing with your opinions. Just giving you the calculations I see with the current pricing model, which was already said would be altered in the future. The current model is flat rate per second regardless of file type or size.

sorry for cluttering this thread. will try to condense number of posts

Edit (07/13/20): Thanks to the diligence of BluBlu in his testing of the network and rate structure we validated the proper packet price. The post has since been revised to reflect current pricing.

They are still playing with the rate structure.

Week 1 packet earning rate per 30 sec of video: $0.0033293 (on avg.) 72 packet sample

Week 3 packet earning rate per 30 sec of video: $0.0097800 (on avg) 30 packet sample

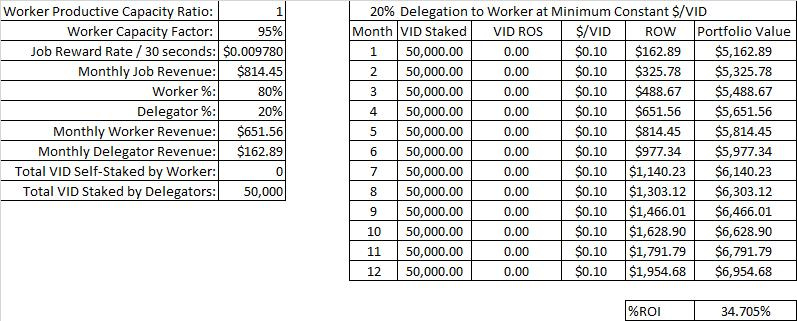

The math assuming a 24/7 CPU utilization rate with a 95% capacity factor (CF) (assuming down time for maintenance):

Assumption: 1 packet of video = 30 seconds of video

Assumption: 1 packet of video takes 30 second for the CPU to process (conservative, my CPU can process 1.4 packets / second)

Monthly earnings / CPU = ($0.00978 / packet) x (1 packet / 30 sec.) x (3600 sec./hr.) x (24 hr. /day) x (365.25/12 days/month) x 0.95 CF = $814.45

The total number of hours of video processed in the month (on average) @ 95% CF by one CPU is 694 hours.

The rate structure per hour is therefore $1.17 / hr. of video. This is PERFECT.

We did a survey of the rate structure from competitors like Encoding.com, AWS, Telestream, Azure, and Qencode. The industry nominal rate is ~ $1.81 / hr. of video. To be competitive you need to offer the same service for at least 35% less to incentivize the switching costs. This means VideCoin should be selling video at ~ $1.17 / hr. of video. There are multipliers for varying complexity algorithms (HEVC being 3x more work than H.264 for example).

This rate structure assumes 1:1 real-time transcoding (1 second of video per second). If this rate structure is adopted the revenue for the VideoCoin Network would break down like this:

Worker Revenue for Work = 0.80 x $814.45 = $651.56 / month

Delegator Revenue = 0.20 x $651.56 = $162.89

I’m going to expound on the above revenue to get an annualized rate as a function of VID invested. Let’s start by assuming VID is at $0.10 / VID on the open market. Next let’s assume that the Delegators stakes at least enough VID with a machine to qualify for most of the 20%. If a Worker is required to self-stake a machine at 50,000 then a Delegator would have to commit at least that 50,000 as replacement for the worker to qualify for work and the split to become perfectly 80/20. The worker would therefore have 0 VID self-staked, the delegator 50,000 VID.

50,000 VID x $0.10 / VID = $5,000 invested (+ VID volatility risk)

Assuming the above video transcoding $-yield, the Delegator would earn $162.89 / month and still be competitive with the centralized CDNs.

$162.89 x 12 months = $1,954.56 / yr. or ($1,954.56 / $5,000) = 39% APR! That’s a huge ROI in any market. Keep in mind that this doesn’t include the appreciation potential of the underlying asset, VID. With more network demand there should be higher prices.

Edit 07/15/20: Some commentators on the Telegram channel wanted greater detail in comparing the Genesis reward to Worker Delegation so I amended this thread to include detailed computations.

Edit 07/20/20: Expanded discussion to include production rate impacts from network total throughput. Definitions for this discussion -

T = D + P + R

T = Total time for processing of a micro-job (packet of video)

D = Delivery time for receiving a packet from the VideoCoin network

P = Production time of transcoding the packet (CPU dependent)

R = Return time to send the packet back to the VideoCoin network

I think it’s important to differentiate between different kinds of rates of return and risks associated with those returns. You also have to differentiate a worker ROI vs. a Delegator ROI. In turn, you then have to sub-divide a Delegator ROI when staking with a Worker vs. staking with VideoCoin Genesis. Let’s address each in kind:

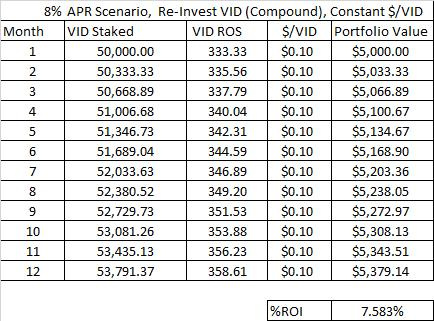

- If a Delegator stakes their VID with VideoCoin Genesis they get an 8% return on that staked VID, but it’s paid in VID. It’s not entirely clear whether or not that’s 8% APR or 8% per month (I would suspect that would be APR because otherwise with compounding VideoCoin would go broke!).

That’s a scenario I just ran with the $/VID price staying at $0.10 / VID market value. It also assumes you take the VID you are awarded by Genesis very month and re-invest it back into your stake. It starts with $5,000 worth of VID (50,000 VID) and then the staked amount grows by 8%/12 APR every month. As you can see that actual %ROI on the investment assuming no change in the underlying asset price is 7.58%, which is the difference between the final account value of VID ($5,379.14) and the initial account value of VID ($5,000). That’s how I view the Genesis block investment if I were a VID holder.

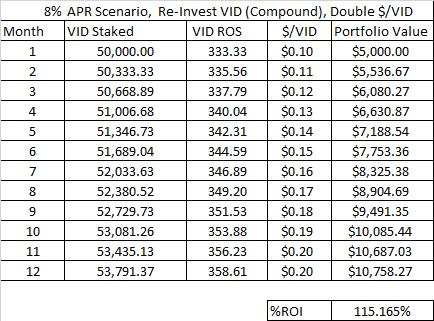

Now let’s assume VID price doubles between now and the end of the year. The %ROI in VID terms is the same but in dollar terms looks like this (the ROI is market demand based, not dependent on Genesis in this scenario, it’s more speculative):

Now let’s look at the scenario with Workers & Staking

As you can see from the table above, by delegating with a worker you get a claim on 20% of all revenues from a job. You don’t increase in your VID holdings, but you also don’t take on volatility risk of holding more of a digital asset. The portfolio value rises in proportion to the work done by the worker. In my scenario I assumed the worker is busy 95% of the time and earning about $0.01/30 second micro-job (which is the current going rate). I also assumed the worker has the compute/bandwidth to process video with a “T” value yielding a 1:1 basis (real-time D+P+R, so it can process 1 second of video every second in 30 second batches), including accounting for network lag time. This may be non-conservative as each persons available bandwidth will vary based on ISP and CPU design will vary based on hardware choice. This majority of our testing efforts moving forward will be towards validating T = D+P+R. Assuming excellent bandwidth and a powerful CPU I anticipate a 1.4: 1 ratio is possible but that also depends on the file bitrate (information density).

Hopefully, this means my CPUs will crunch things faster than the network can deliver (which is a bit of a waste from a capital utilization standpoint but desirable). Lot’s of assumptions! We need network saturation to see the real value flow and performance on an individual worker basis.

So the question is, do you stake with Genesis for 8% APR VID ROI or with a worker? My answer is “it depends”. If the network has no work, by all means get what you can, it’s free value! If the network gets saturated with work then you are losing value not sharing in worker revenues. I hope that makes sense.

You are mixing subjects. Content curation / delivery by a Netflix or Hulu is not the same as video transcoding. The only overlap between the two is in storage / delivery.

Think about it. Netflix may get a native file from post-production from a studio. That file is probably huge (150 GB for a 4K UHD 2 hour movie). Obviously streaming that movie to all the end users around the world would saturate the internet and break Akamai / ISPs, and probabluy everyone else. It has to first be transcoded, either before distribution or real-time depending on the algorithm.

The compute (transcoding) is the most expensive portion of the process but it only has to be done a few times depending on the desired output file characteristics. Even the output can be further transcoded on the fly to accomodate cell phones and such.

It is therefore inappropriate to compare a subscription service like Netflix to an encoding rate provided by VideoCoin. A more appropriate comparison is discussed above in another part of this thread.

I think the tokenomics discussion should consider the fact that VideoCoin is an open and transparent platform and works towards maximizing the benefits of all the participants i.e. the VID holders, publishers and workers(compute resource owners). The network parameters such as staking limits and reward percentages get tuned to achieve that. VideoCoin tokenomics become very vibrant and dynamic as the strategies will evolve based on inputs from the community forums like this.

Openness and transparency of the platform on technical front should fuel the growth of platform tremendously. Even though the VideoCoin Console provides an easy to use interface, the network’s strength lies in simple yet powerful API that can be used programmatically to build very powerful video applications. Once the developer community for VideoCoin grows, it can embrace advancements in compression technology such as VVC, and Video analytics much aggressively compared to any closed systems. Growth of the platform in this direction enables it to offer premium services.

I think the VideoCoin tokenomics should fuel the growth of the platform while incentivizing the early participants.

(This is my personal openion as a forum user and not reflective of any VideoCoin policies )

Is the mathematics in the first graphic presented in this thread correct based on the current programmed distribution amounts?

BTW, I agree on your sentiments. This is why I’m so bullish on this project, it’s a wonderful balance between everyone in the ecosystem with your company as a good steward.

Keep building!

A quick glance at the calculation in the graph seems to be correct.

The main purpose of the staking(mainly delegated staking) is to secure the network (by ranking the worker pools) and self-stake is to fulfill the commitment by the worker to deliver the work at agreed quality( which will be enforced by slashing if enabled). Reward distribution is an incentive to encourage VID holders to participate in network security.

I have a question regarding the points you made. You calculated a ROI of 37% but that only includes the cost of staking 50 000 vid token. what returns should someone expect once they include the cost of hardware+ OPex ? wouldnt that be much lower ROI.

Of course, yes, the ROI only considers the return on VID staked, not on OpEx or CapEx. As a business, we at Block Digital Corporation are committing to making the latter two the most competitive in the entire industry. You are on to us!

Thanks for your response but I am afraidthe ROI will become so poor that it wouldn’t be a good incentive at all to run a worker node.

Even the best hardwares and cheap electricy will still bring the cost to somewhere no better than 10% return which would would be very disappointing. Many projects already offer such returns with staking only.

Am I missing something here?

Edit: unless you consider the added value token price appreciation will have on the mid/long term on total return as the network grows. But I don’t think that is something you consider when making your decisions on whether or not to have worker station.